Steps to Become a Profitable Trader

Trading with Price action 1st Chapter

In the trading world today, many various strategies are being discussed in the trading market for becoming profitable, but the Essential keys in become profitable in the trading space all boil down to technical analysis and trading phycology.

Understanding the technical aspect of trading takes quite a while to be able to master efficiently, In the world today there consist of various technical strategies, like the trendline (breakout and retest), the indicators, the Fibonacci, Price action and more. All these are various strategies used by most profitable and successful traders, but the one I prefer and find the most efficient is price action. The reason is because the market moves with time and price and it is constantly evolving, in this case, the knowledge of price action helps you by being up to date on the current market situations.

To fully understand price action, you first have to let go of all other strategies you have on your sleeves to avoid misapprehensions before we continue, price action simply refers to understanding the demand and supply in the market, this also comes with various strategies like the smart money concept(SMC), Institutional concept of trading(ICT), Wykoff method, etc. All these are various ways in which demand and supply are utilized efficiently.

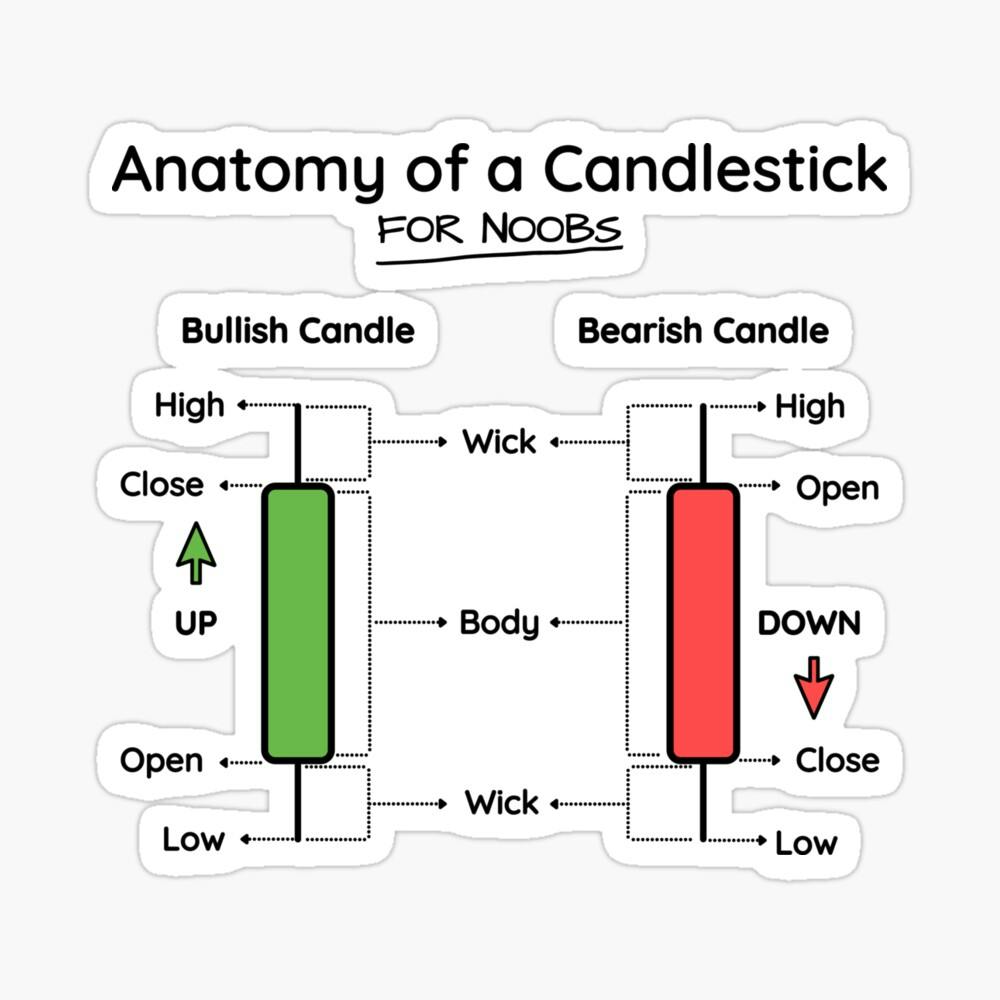

To efficiently grasp this technique, you need to have the basics of candlesticks anatomy, knowing when a candle opens and close, knowing the high and low of the candle, and knowing the order flow of the market.

In other words, knowing your market structure more efficiently makes you a step ahead in becoming profitable in this trading space. Now let's talk about Trading psychology.

Trading Psychology refers to the emotions and mental state that help dictate success or failure in trading, it involves your mindset when trading and when you’re not trading. Discipline and risk management are two of the most critical aspects of trading psychology since the implementation of these is critical to a successful and effective Trading Plan.

A consistently profitable trader specializes in one or two strategies he/she focuses on trading those flawlessly. To be a Profitable trader you must first set your mindset that trading is not a rich quick scheme, it’s a steady business whose keyword is “consistency”, you must start small and expunge every atom of greed. For a trader not to be greedy, you must enjoy the little profit you’re making, for example, if you are making 5$ in a day the compound interest in a month will be at approximately 150$. Another aspect of trading psychology is Fear. The fear of loss, no one likes to lose money. But unfortunately, losses are part of the Trading World which must set a mindset on how to approach it, for example before I consider taking a trade I must check and set my risk-to-reward ratio.

The highlighted part of the image is the value of the risk-to-reward ratio of a trade which is the target divided by the stop

In other to approach fear in trading you must risk what you can afford to lose and try not to open too many orders at once.